August 30, 2011

China-Japan-South Korea FTA accelerates as the TPP gains ever more momentum

As the Trans-Pacific Partnership (TPP) negotiations press ahead, led by the US, Australia, and New Zealand, preparations are accelerating for the long-considered China-Japan-South Korea Free Trade Agreement (CJK FTA). China, Japan and Korea have been studying the potential for an FTA since the idea was first tabled at a trilateral summit 1999, but progress has been held back by a number of issues, including regional trade imbalances and agriculture. At a summit in May of this year, however, the three countries agreed that preparations for the CJK FTA need to move faster; this new-found sense of urgency likely comes from the pace of TPP negotiations—and the expanding number of countries joining negotiations—and the fact that neither China nor Japan are involved in the TPP. A situation where a TPP would be in effect, but not a CJK FTA, would be one where Chinese and especially Japanese exporters find themselves at a disadvantage in the Asian region.

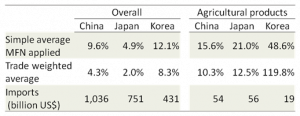

The collaborative feasibility studies carried out by government officials and researchers from each of the three countries have noted that agriculture remains a major constraint on CJK FTA completion. China’s tariffs on agriculture imports are the lowest of the three, a legacy of the tough conditions it agreed to as part of its ascension to the WTO. Japan’s tariffs are slightly higher than China’s, but nowhere near South Korean levels, which are among the highest in the world. Non-tariff barriers, such as SPS restrictions, are generally high in the region, as well.

The collaborative feasibility studies carried out by government officials and researchers from each of the three countries have noted that agriculture remains a major constraint on CJK FTA completion. China’s tariffs on agriculture imports are the lowest of the three, a legacy of the tough conditions it agreed to as part of its ascension to the WTO. Japan’s tariffs are slightly higher than China’s, but nowhere near South Korean levels, which are among the highest in the world. Non-tariff barriers, such as SPS restrictions, are generally high in the region, as well.

Yet, considering the low volume of agricultural goods that are traded between the three countries, one would expect barriers in this sector to be a side issue compared to negotiations over access for manufactured goods. Japan’s share of China and South Korea’s trade in agricultural goods has fallen from 39.9% and 60.5%, respectively, in 2000 to 17.2% and 32.9% in 2009. Its imports from China, for the most part, are comprised of meat and processed seafood, the latter of which is set to decline as production moves to Vietnam and Thailand over safety concerns and rising labor costs in China. From South Korea, Japan mainly imports alcohol and kimchi, the Korean fermented cabbage dish which has gained popularity in Japan over the years; neither of these two products threaten Japanese domestic producers.

The decline in intra-regional trade in agricultural goods, coupled with lower tariffs and the TPP’s role as a motivating factor, means that agriculture is less of an impediment to a CJK FTA than it once was.